Delegates to the Summit were changemakers and global thought leaders hailing from all across the globe and representing the entire value chain of investment; from fund and asset managers, multilateral banks and development finance institutions, pension funds, corporations, and foundations and family offices, to ecosystem builders, financial intermediaries, policy makers, academics, research and ratings firms, and international NGOs already engaged in impact investing. A select group of high net worth individuals and philanthropists represented catalytic capital, while inspiring entrepreneurs represent the demand side for capital. Whether you are already actively moving capital through a gender lens, or on the verge of breaking ground, the Summit acted as a catalyst for scale, strategy, and action.

We were committed to ensuring delegate representation from both the Global South and North regions – from South Africa to Sweden, Jakarta to Japan, London to Lima, and beyond.

Downloads

Post-Summit Content Report, Presented by CDC Group

Agenda and Speakers

Partners and Supporters

We are deeply indebted to the visionary leaders, organisations, and funders that have provided the critical support needed to launch the inaugural 2018 Gender-Smart Investing Summit. Please enjoy our Sponsors Highlights Reel from the Summit:

2018 Advisory Council

In addition to our core team, we recognise the critical contribution of the following industry leaders and champions of gender-smart investing, all of whom support our efforts to ensure the most relevant, pressing topics are featured in the Summit agenda, in addition to advancing speaker, keynote, and facilitator selection and outreach.

Joy Anderson, Criterion Institute

Samina Anwar, UNCDF

Jennifer Braswell, CDC Group

Shalaka Joshi, IFC

Kate Murphy, Open Society Foundations

Ruth Shaber, Tara Health Foundation

Laurie Spengler, Enclude

Alexander Stiehler, UBS

James Soukamneuth, Investing in Women

Nancy Swanson, Linked Foundation

Jackie VanderBrug, US Trust

Rachel Whittaker, UBS

Commitments

Summit participants announced financial commitments totalling US$9 billion toward initiatives that will ultimately drive more than US $1 trillion of capital into gender-smart investments worldwide. Some of these funds target regions such as Latin America, which have never previously had a dedicated gender lens fund beyond microfinance, while others have achieved unprecedented levels of buy-in from senior leadership who are recognizing both the opportunity of gender lens investing as well as the risk of not adopting this level of analysis in their funds.

Additionally, six other Summit participants announced the development of new tools, resources, and knowledge sharing opportunities that could potentially reach millions of women in the coming year.

+ Criterion Institute’s Finance to Address Gender Based Violence ($US1T)

Criterion’s goal is to gather and coordinate the movement of $1T in investments that address gender-based violence. They raised $7B in commitments at the Summit from delegates.

+ Development Finance Institutions 2X Challenge: Financing for Women (US $3B)

The 2X Challenge is a commitment to deploy $3B by 2020 for investment in business activities that will benefit women launched by a consortium of seven DFIs from the United States, Canada, the United Kingdom, France, Italy, and Japan. It is led by a $1B commitment to invest in women in emerging markets by the United States’ Overseas Private Investment Corporation (OPIC). At the Summit, the 2X Challenge members announced progress on several fronts:

- The DFI Consortium launched the website with criteria for 2X Challenge Funds

- Katie Kaufman of OPIC – applying a gender lens across our whole portfolio, and get others EDGE certified

- Anne-Marie Levesque, FinDev Canada – increase flow of capital to 2x Challenge businesses

- Jen Braswell, CDC – new live website communicating collective approach to all deals, including the public criteria used to evaluate what makes a deal 2X eligible https://www.2xchallenge.org/

- JICA – Technical Assistance, grant, and loan assistance with gender as an area of focus

DFI Gender Finance Collaborative Commitment Statement

“We can catalyse so much greater levels of results with collaboration. We are pleased to announce that the highest officers of each of our organisations has signed the commitment to demonstrating investment with a gender lens, support opportunities to improve lives around the globe, and promote increases in women in leadership.”

14 DFIs have joined together as the Gender Finance Collaborative, with the collective goal of advancing women in leadership and governance and across the value chain: FMO, FinDev Canada, OPIC, CDC Group (present), and others, with support of Suzanne Biegel and Carey Bohjanen as co-leads. The group share a common joint responsibility to champion gender within their respective organisations. See websites of CDC, FMO, Proparco FinDev Canada, and DEG for this Joint Commitment Statement.

+ The Billion Dollar Fund for Women

Their goal is to mobilize a global consortium of venture funds that will pledge to invest in women founded companies. Shelley Porges, co-founder, announced that they have USD$500m in commitments, as of the date of the Summit, after just three months.

+ SheEO

They commit to raise $1 billion in capital for women entrepreneurs through their innovative financing approach, 500 women in each geographic region, annually, growing regions and countries every year.

+ Canadian Government

They will contribute up to CAD $300m to its partnership to support women and girls, which will be launched in Vancouver in June 2019 (field building, TA, grant, investment)

+ Fund Mujer

The fund was established by OPIC and IDB Invest in autumn, 2018 will be a LAC $200 million fund specifically to invest in Latin American women. It is the first fund of its kind.

+ We Are Enough

They have launched a global campaign to drive capital – big and small – into women owned businesses and with a gender lens – with women as investors.

+ C-Note

They have created the Wisdom Fund Collective for closing the wealth gap for women and women of colour in lower middle income (LMI) activities in the US.

+ Tara Health Foundation

They will support a data standardisation project. This will be focused on:

- The key metrics that connect social and financial performance around gender

- Better understanding how to measure social impact

- Methodology to provide those data

+ Women Deliver

They committed to a finance track within the Power theme for the 7000 people on-site and 100000 off-site gathered to address investment in women.

+ Frontier Markets and FMO

They will catalyse investment for women entrepreneurs, scale access to energy through women. An initiative that will influence 10,000 women. FMO is financing this and looking for co-investors.

+ ANDE: Gender Lens Impact Measurement Fund

ANDE has created a facility for driving the practice of gender impact measurement in Latin America. Commitment to share the findings across all regions, and bring this same fund to other emerging markets and regions.

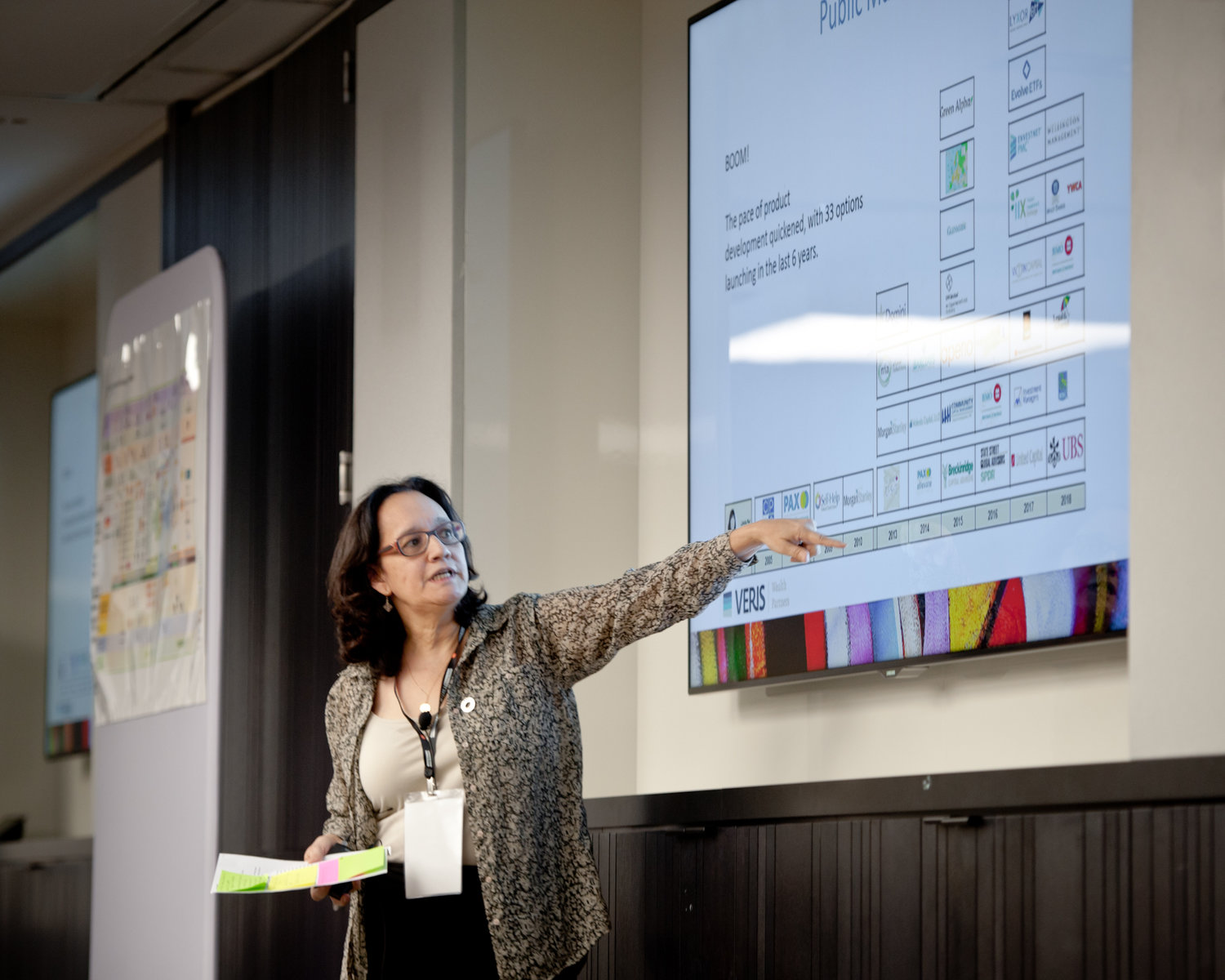

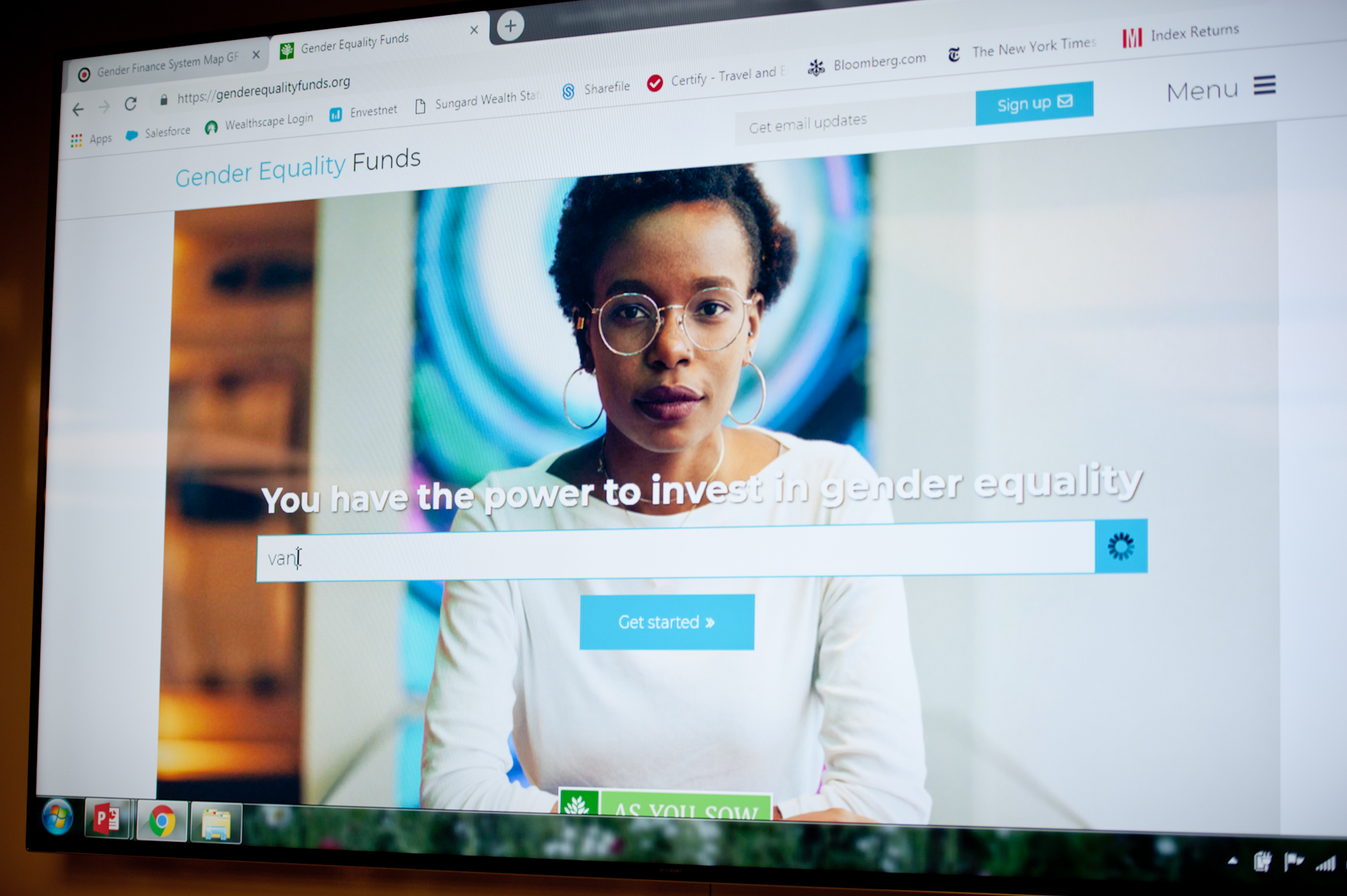

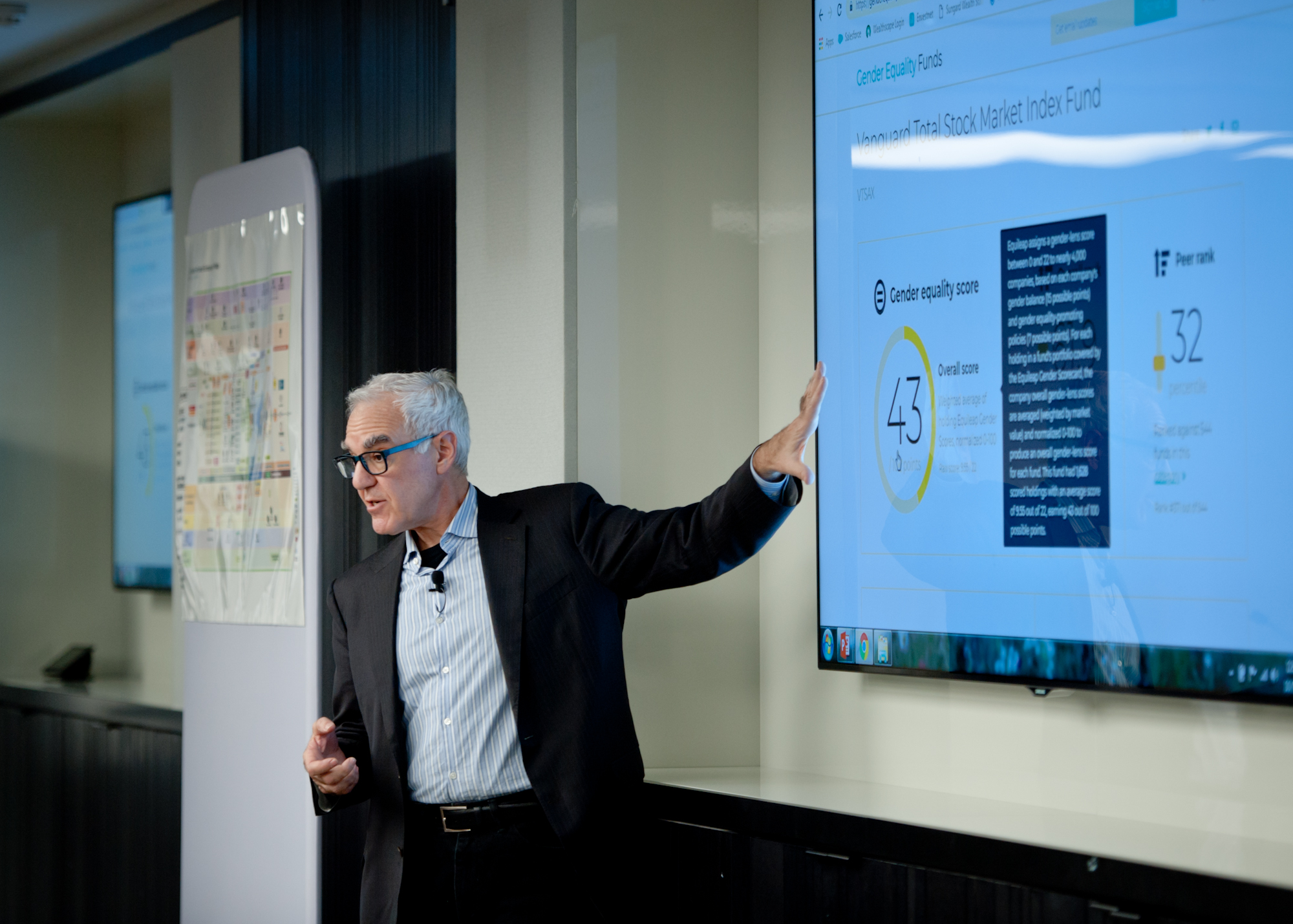

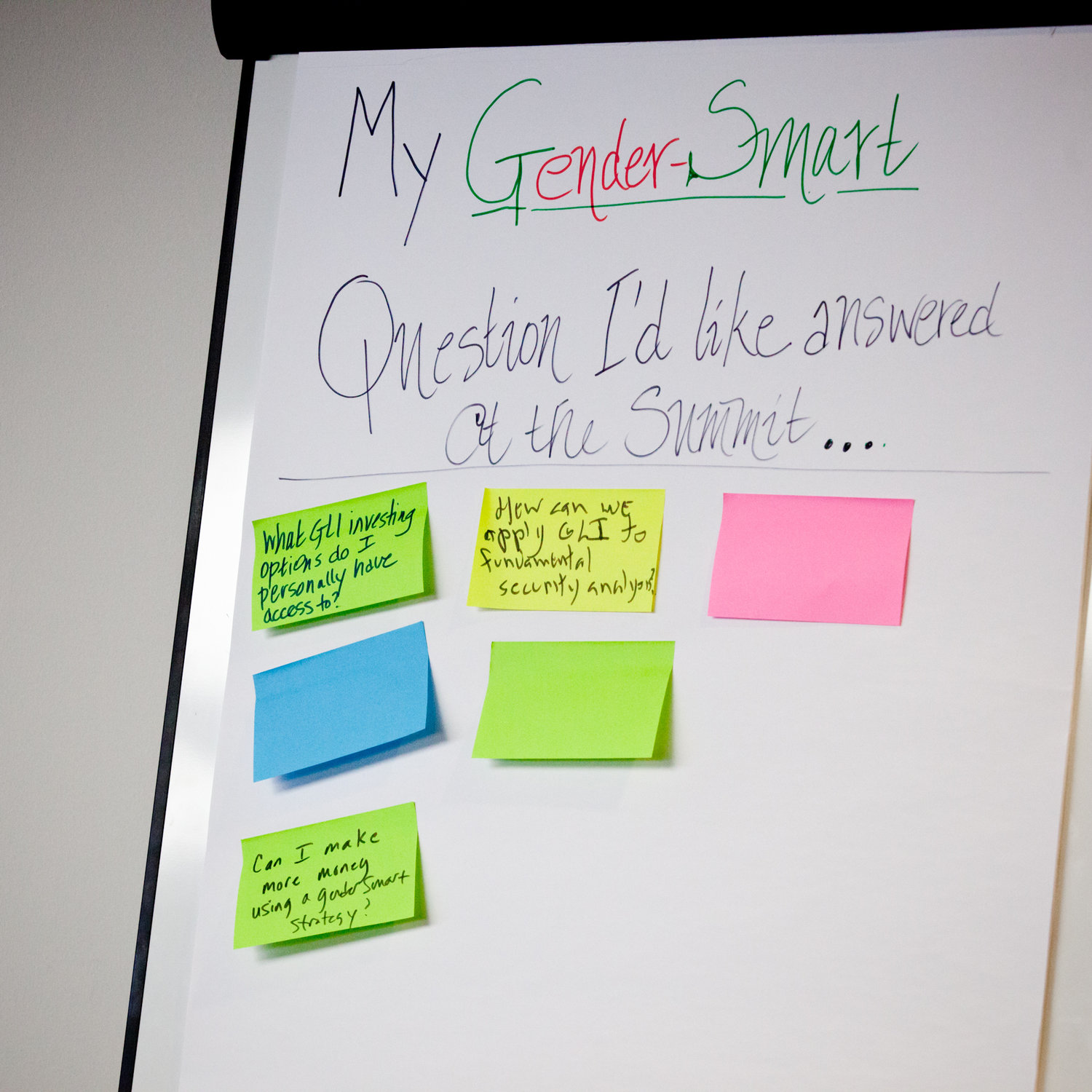

+ As You Sow: Gender Equality Funds Tool

They commit to launch the gender equality funds tool and put together advocacy directed to those companies that do not do well.

+ Invest4Equality initiative

OIga Miler launched this effort at the Summit with the intention of gathering a community around Invest4Equality’s five commitments. Commitment to bring in 1 million signatures in the next 2 years.

Video Highlights

As anyone who attended the inaugural Summit knows, our outcome- and dialogue-driven programme revolved around 35 breakout sessions and structured conversations, which were not easy to capture on video. Given that, please do enjoy and share our main stage highlights.

Suzanne Biegel, Catalyst at Large and Co-Founder, GenderSmart

Perspectives from the Spectrum of Capital

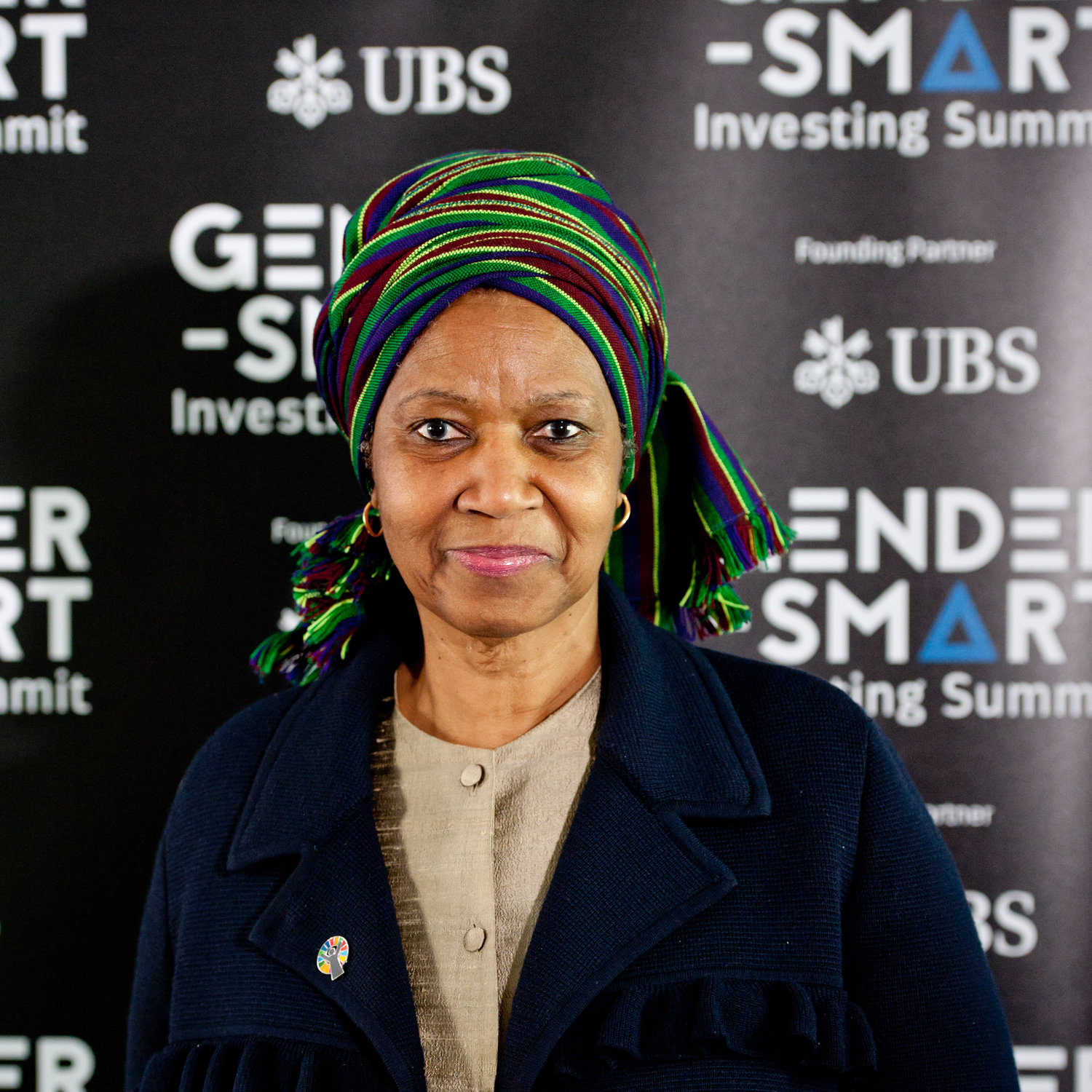

Phumzile Mlambo Ngcuka, Executive Director of UN Women

Poetry

Written by Luisamaria Ruiz Carlile for the 2018 Summit.