Programme

Sessions on:

Pioneering Gender and Climate Investment: Lessons At the Leading Edge / Transformational Impact Through New Capital Structures / Building an Investable Care Economy / Beyond 1.3%: Diversifying the Global Allocator Base / Investing in Gender and Climate Finance With a Diversity Lens / Unlocking Women’s Wealth / What’s Next and What’s Needed in Gender Analysis / Expanding ESG: Where are Gender and Social Equity in the Public Markets? / Underserved Entrepreneurs: An Unmet Opportunity

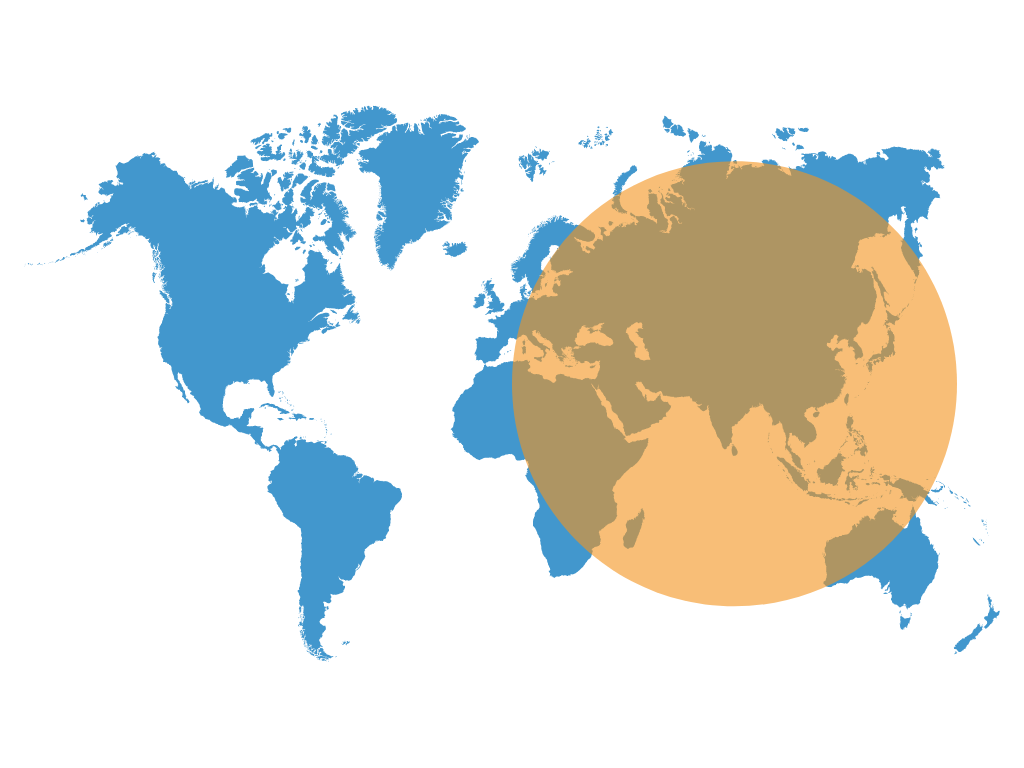

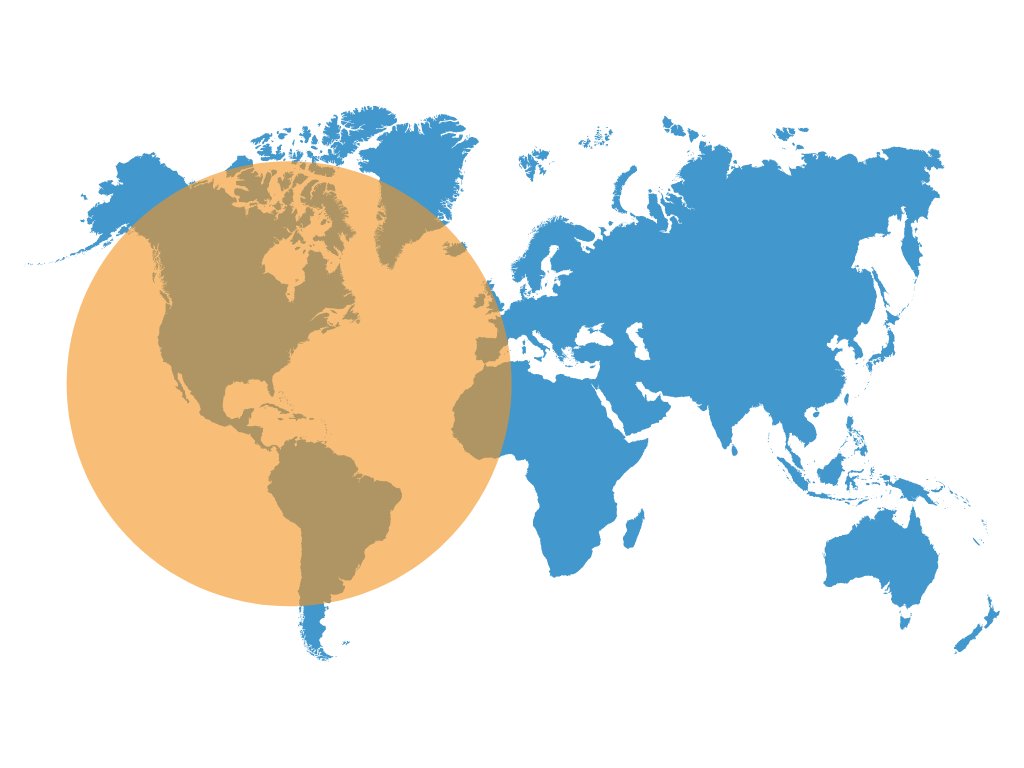

Most sessions will be held in two timezones to accommodate our global audience.

Timezone A

CET, GMT, AET, IST, AEST, SGT

Timezone B

CET, GMT, EST, PST, CST

Sessions and Resources

Browse past sessions and speakers here, alongside any useful resources shared.

What does it mean to create 'fit for purpose' capital? How can we reimagine and reinvent financial systems and solutions that work for women, diverse and non-binary entrepreneurs? This session explored these questions and more with SheEO's Vicki Saunders.

The venture capital model doesn’t work for many startups and small businesses, often headed by female founders and those from diverse racial backgrounds. From revenue-based financing to distributed ownership, this session explored what's working, what's not, and what else might be on the horizon with Aunnie Patton Power.

As the face of wealth diversifies, and women investors demand more sustainable options, this session explored the increasing importance of gender-smart investing products and advisors. Participants heard from this powerful and fast-growing investor demographic, and learned about innovative models and approaches that are meeting next-gen wealth holder needs and demands.

This session brought together the voices of the private sector, public policy, and corporate investment to address ecosystem gaps and strategies in one of the hottest emerging investable GLI themes. Participants identified tools, measurement indicators, and ways to integrate investable opportunities into their strategies and portfolios. Integrates both developed and emerging market examples.

This session brought together the voices of the private sector, public policy, and corporate investment to address ecosystem gaps and strategies in one of the hottest emerging investable GLI themes. Participants identified tools, measurement indicators, and ways to integrate investable opportunities into their strategies and portfolios. Integrated both developed and emerging market examples.

What is the current state of the gender lens investing field? Where are we vanguard? What more is possible? How do we get there? This expert Q&A session with gender lens investing founders and pioneers Joy Anderson and Suzanne Biegel will provided insight into the evolution of the field, where we are now, and where we can and ought to be going.

A deep dive on Sweef Capital’s Gender ROI™ (Resilience, Opportunity, Inclusion) Tool, which helps to reveal economic inequalities, discrimination and lack of representation women face as entrepreneurs, employees, and consumers.

As ESG strategies become more widely adopted and sophisticated, this session analysed what it really means to invest in the 'S' as the next frontier in public markets. Against a backdrop of increasingly rigorous regulatory requirements and a greater attention to racial and social justice, we explored how data and analysis are evolving, the growth in investable products, and the role of shareholder and board engagement.

Whether investors are aiming for good, green jobs as part of a Just Transition, or putting inclusion firmly at the centre of their net zero and green economy strategies, applying a gender and equity lens has the potential to amplify the power of those investments. This session explored how, by integrating diversity into investment design and governance, allocators can promote equitable access to capital and ownership of solutions for the communities that need them most.

In this working session Patience Marime-Ball and Ruth Shaber and participants identified barriers to mainstreaming gender lens investing and developed an influence strategy. The experts drew on insights and data unearthed while researching their new book, The XX Edge, written to bring more mainstream actors on board.

Got questions on what a gender smart climate investment really is and on how to promote them in your context? Are you curious about the 2X Green toolkit and looking for entry points to use a gender lens to climate investments or vice versa? This expert session explored ways to accelerate gender smart climate finance.

Getting more capital and support to underserved entrepreneurs and markets is a key goal of gender finance - and a growth opportunity for investors. This session shared best practice case studies and successful models, and identified the data, tools and analysis needed to deploy more capital where it’s needed most.

Getting more capital and support to underserved entrepreneurs and markets is a key goal of gender finance - and a growth opportunity for investors. This session shared best practice case studies and successful models, and identified the data, tools and analysis needed to deploy more capital where it’s needed most.

How can blended finance support gender equality? What opportunities are there for investors and deal sponsors to use blended finance to promote equal opportunity? Join this expert session for insights on current trends, to understand how SDG 5 is interlinked with other SDGs, and learn about concrete examples of blended finance transactions that address SDG 5.

This session focused on localised approaches for gender lens investing (GLI). Tim Radjy- Founder and Managing Partner of AlphaMundi Group- will talk about his experience on GLI and in the Gender Lens Initiative for Switzerland (GLIS), to enhance the Swiss contribution to SDG5.

According to the Knight Foundation, 98.7% of assets under management in the US are managed by white men. Women and diverse fund managers remain under-resourced and underserved. We explored scalable solutions and innovative approaches to cultivate the next tier of underrepresented fund managers and change the face of capital allocation.

According to the Knight Foundation, 98.7% of assets under management in the US are managed by white men. Women and diverse fund managers remain under-resourced and underserved. We explored scalable solutions and innovative approaches to cultivate the next tier of underrepresented fund managers and change the face of capital allocation.

Curious about how to structure a gender lens into the legal documentation of a transaction/vehicle/fund? Wondering which legal terms and conditions can be applied across the risk-return spectrum? This expert hour answered legal and structuring questions and helped participants level up their legal levers.

Equileap’s Co-Founder fields questions about the scorecard: how is it unique, what data does it collect, and how? How has Equileap seen data shifting over time, and what are the trends at national and global levels? How is the gender data leveraged by different actors in the financial sector?

The adoption of a dual gender and climate lens in our investments will be crucial if we are to achieve the goals of the Paris Agreement by 2050. Across sectors, in both developed and emerging markets, this approach offers amplified impacts and returns. How might we unlock its potential at the pace and scale that’s needed? And what can we learn from our experiences so far, to help investors hit the ground running? This session explored what’s working and what’s not, with a deep dive into the ‘how’ of gender and climate investment.

The adoption of a dual gender and climate lens in our investments will be crucial if we are to achieve the goals of the Paris Agreement by 2050. Across sectors, in both developed and emerging markets, this approach offers amplified impacts and returns. How might we unlock its potential at the pace and scale that’s needed? And what can we learn from our experiences so far, to help investors hit the ground running? This session explored what’s working and what’s not, with a deep dive into the ‘how’ of gender and climate investment.

Got questions about how gender inequity and violence are hidden investment risks? Do you want to think together about risk in specific sectors, markets, and enterprises? We discussed how to go about this analysis, and how to make the case that it matters.

More actors are waking up to gender finance’s potential as a tool for social change. Find out how it can address development gaps, from healthcare and financial inclusion to the future of work. This session focused on innovative models and structures across blended finance, fund of funds and other structures that integrate gender and equity and mitigate systemic risk.

More actors are waking up to gender finance’s potential as a tool for social change. Find out how it can address development gaps, from healthcare and financial inclusion to the future of work. This session will focus on innovative models and structures across blended finance, fund of funds and other structures that integrate gender and equity and mitigate systemic risk.

This expert Q&A session helped participants identify opportunities to redefine notions of risk and build in JEDI and ESG as a core part of their investment strategies.

Got questions on the 2X Criteria and are seeking answers on how to apply them in your context? Are you curious about 2X and looking where to start or levelling up? This expert session helped participants to demystify the 2X criteria.

Gender finance doesn’t just need more data, it needs better analysis - within both gender and finance. This session will go beyond making the case to define what good looks like today. From incorporating intersectionality and the needs of communities rather than capital, how might we translate valuable insights across asset classes, structures and regions?

Gender finance doesn’t just need more data, it needs better analysis - within both gender and finance. This session will go beyond making the case to define what good looks like today. From incorporating intersectionality and the needs of communities rather than capital, how might we translate valuable insights across asset classes, structures and regions?

This climate and gender investing foundations session explored what it means to bring gender and climate together from an investment perspective, and how to make the case for this approach with the available data and case studies.

This climate and gender investing foundations session explored what it means to bring gender and climate together from an investment perspective, and how to make the case for this approach with the available data and case studies.

Speakers & Facilitators

Below is a snapshot of some of the people leading or facilitating a Virtual Programme session.

Michelle is Co-Founder of The Beam Network, a membership-based organisation that focuses on financial education to enable women to have greater involvement in the management of their wealth and finances, whilst driving the movement towards financial systems and economic opportunities that are more inclusive and more sustainable.

Lelemba Phiri is an award winning educator, writer, keynote speaker and gender-lens angel investor. She is the Principal at the Africa Trust Group that takes a holistic approach to investing in women by investing in both the woman entrepreneur and the enterprise; and facilitating their access to markets and critical business tools. She is the Operating Partner for the US based Enygma Ventures Fund that is focused on investing in women entrepreneurs in SADC.

Eva has 17 years of experience working in the venture capital and asset management industries. She is currently the General Partner of Beyond Capital Ventures, a women-led impact venture capital firm, offering a diversified portfolio of companies in "need-to-have" sectors, led by conscious leaders; and CEO of Beyond Capital Fund an early stage investment fund that improves lives with its early investments.

Marijn Wiersma joined British International Investment as Interim Gender Lead on 28 August 2020. Previously, Marijn worked for Arise Invest in Cape Town, where she set up and was heading their sustainable and inclusive finance work across the African continent. Prior to that she was, amongst other roles, Senior Financial Inclusion Advisor for FMO from 2008 until 2017.

Dr. Katharine Wilkinson is an author, strategist, teacher and one of 15 “women who will save the world,” according to Time magazine.” Her books on climate include the best-selling anthology “All We Can Save: Truth, Courage, and Solutions for the Climate Crisis”; “The Drawdown Review: Climate Solutions for a New Decade”; the New York Times best seller “Drawdown: The Most Comprehensive Plan Ever Proposed to Reverse Global Warming”; and “Between God & Green: How Evangelicals Are Cultivating a Middle Ground on Climate Change.” A former Rhodes scholar, she is co-founder of The All We Can Save Project, in support of women leading on climate, and co-host of the podcast “A Matter of Degrees.”

Rachel Whittaker is Head of the Sustainability Investing Research Team at Robeco. She previously worked for Robeco from 2015 to 2017 as a Senior SI Analyst, and now leads a growing international team of SI analysts. Her team’s responsibilities include identifying the impact ESG has on business fundamentals, increasing and broadening SI sector knowledge and further developing the SDG framework for mapping and measuring SDG contributions across all investment portfolios. Before rejoining Robeco in 2021, she worked at UBS as SI strategist in the CIO Office of the global wealth management arm. Prior to joining Robeco in 2015, she worked in various SI roles for the UN PRI, Vontobel Asset Management, and Mercer’s Investment Consulting business. She started her career in 2000 as a sell-side equity research analyst. Rachel earned her undergraduate at the University of Cambridge, and an MSc in Corporate Environmental Management at the University of Surrey, UK. She is a CFA® charterholder.

Emma Wheeler is an Executive Director and Head of the Women’s wealth program at UBS Global Wealth Management. This well-established and thought-leading program has focused since January 2017 on supporting the financial confidence, participation and wellbeing of female clients, mainstreaming the financial challenges that women face and driving wider financial services industry change to address these. The program also encompasses the topic of Gender Finance and the bank’s involvement with the Gender Smart Investing Summit, the global gathering of thought leaders to drive forward this investment megatrend.

Moa Westman is a Gender Specialist at the European Investment Bank (EIB). She has ten years of experience in promoting gender equality and women’s empowerment in climate and environment related investments, policies and projects in the private and public sector.

Teresa is the MD of Tiedemann Advisors and co-leads the firm’s Seattle office, where she has direct responsibility for managing client relationships. She works closely with clients to understand their goals and objectives; manage their investments, including impact investing; and integrate their investment strategy, philanthropy, and estate planning into a cohesive wealth management plan. She serves as a member of the firm’s Internal Investment Committee and is also on the Diversity, Equity and Inclusion Committee.

Steven is an investment banker by training, having joined Palladium in 2014, after working in the investment banking teams at Merrill Lynch (now Bank of America) and Citi in both London and Johannesburg. In these firms, he specialised in corporate finance (balance sheet optimisation, structuring equity and equity-linked financings and debt advisory), before taking on wider coverage roles (which also included M&A).