18-19 October, 2022

Kings Place, London

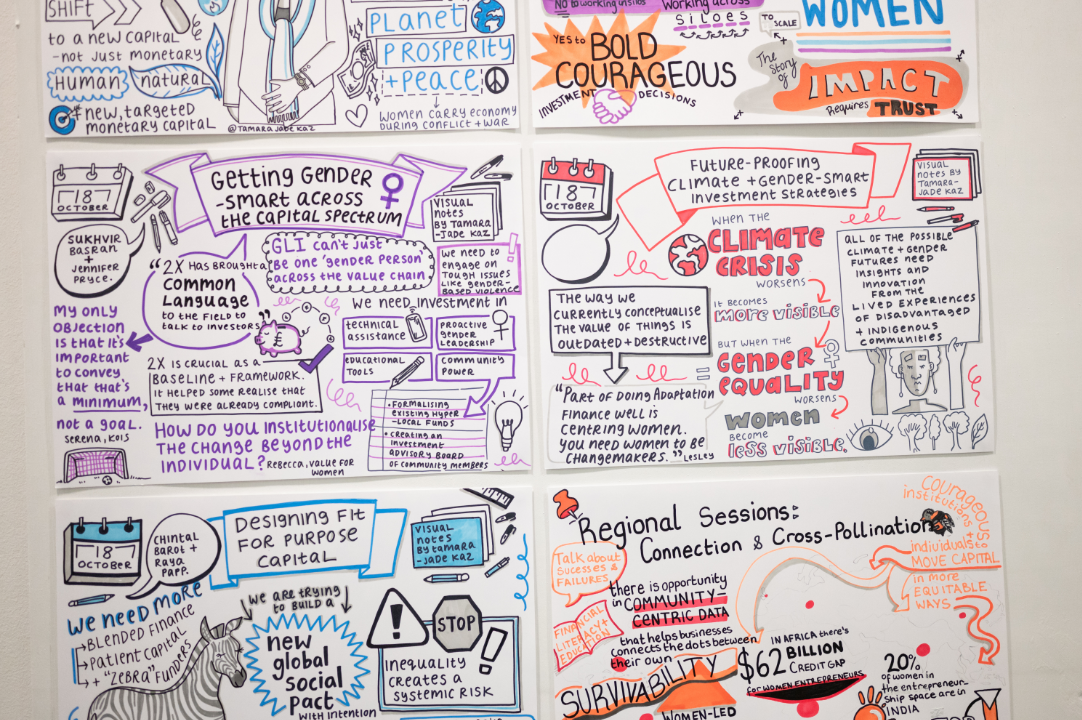

Against a backdrop of social and economic turmoil, a growing cadre of institutional investors in both developed and emerging markets are recognising the power of integrating a gender and broader equity lens. Their recent capital commitments, coupled with forthcoming policy shifts, are sending strong signals to the marketplace that gender is material.

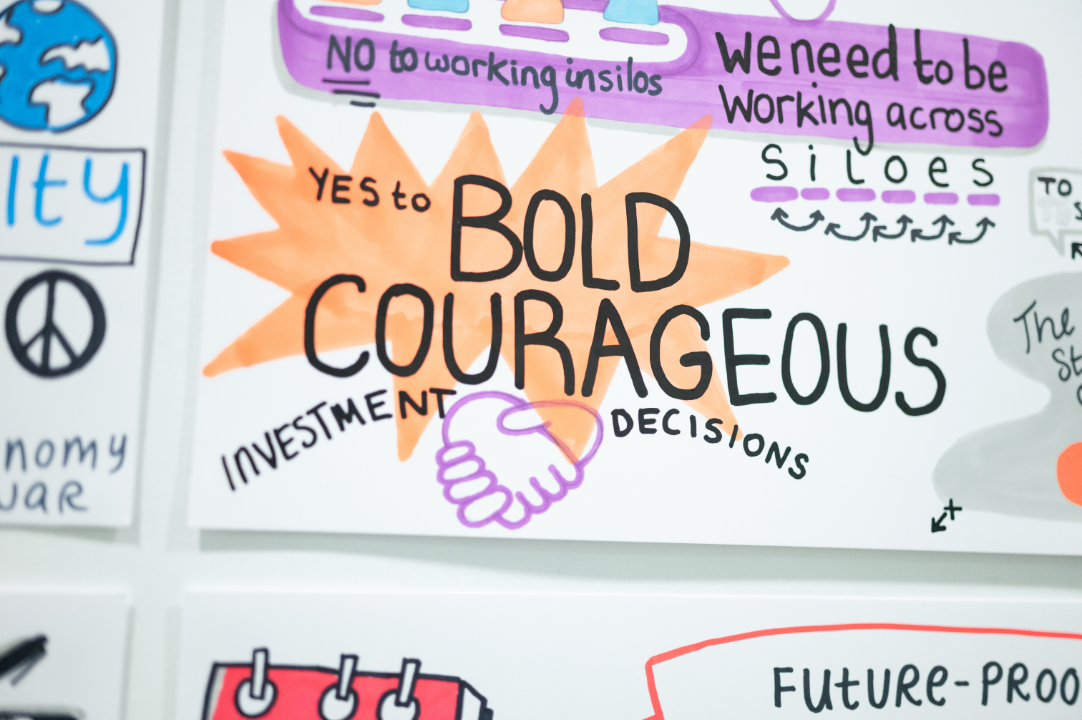

At the other end of the spectrum, leading edge influencers continue to push for radically different approaches to financial systems, engaging in conversations about power and transformation, and bringing new voices to the table to effect truly equitable and impactful investment outcomes.

Both are equally important. The future we all want will only be possible if both institutional influence and outlier innovation come together. Now is the time to look beyond the silos, and adopt a systemic approach to deploying capital across the spectrum of gender-smart investing.

Agenda

“The Summit’s programme was co-created to provide a creative, expansive and solutions-oriented forum. We invited each delegate to come ready to deepen their investment strategies and move towards a better financial system and a more equitable, sustainable world.”

Monday 17 October

Pre-Summit Welcome, Hosted by UBS

17:00-18:00: Panel discussion

18:00-19:30: Opening reception

Tuesday 18 October

Wednesday 19 October

Thursday 20 October

2X Collaborative Annual Member Meeting

By Invitation Only

Facilitators

Summit facilitators are peers guided delegate discussion and activity in working sessions over the two days. With the exception of the plenary, there were no talks or lectures: delegates were prompted and invited to participate.

Dr. Joy Anderson is a prominent leader at the intersection of finance and social change and has been instrumental in shaping the field of gender lens investing. She is founder and president of Criterion Institute, the leading think tank on using finance as a tool for social change, which demonstrates new possibilities through its groundbreaking research, innovative trainings, convenings, and multi-stakeholder engagement to uncover innovative pathways to action.

Hany Assaad co-founded and has been Chief Portfolio & Risk Officer of Avanz Capital since its establishment, and is the Managing Director of Avanz Capital Egypt, an Egyptian asset management company and a subsidiary of Avanz Capital, established to manage fund-of-funds and other specialist private capital funds in Egypt to invest in VC and PE funds targeting startups and SMEs as well as specialized climate funds.

Ibukun Awosika is an African entrepreneur, author, international leader, and a global culture shaper. She is the Chairman and Founder of The Chair Centre Group, a leading furniture and security systems provider in Nigeria. She is the founder of Ibukun Awosika Leadership Academy and also the founder of the Christian Missionary Fund, a faith-based organization spread across Nigeria to change lives.

Dolika Banda is an independent Non-executive Director at Harith Infrastructure Investment and a Global Ambassador for The Global Steering Group for Impact Investment. She is the former CEO of African Risk Capacity Insurance Ltd and has held Non-Executive Director positions at Ecobank Transnational and the UK Department for International Development’s Financial Sector Deepening Africa programme.

Chintal is the founder of CoSustain Consulting, and focuses on climate and gender-smart investing in emerging markets. She facilitates multi-stakeholder processes, workshops and delivers training on climate and gender-smart investing to investors and investee companies. She is a strategic advisor to the 2X Collaborative's Investment Officer and Climate and Gender Working Groups, and a Sector Advisor at the Said Business School at the University of Oxford, where she mentors students.

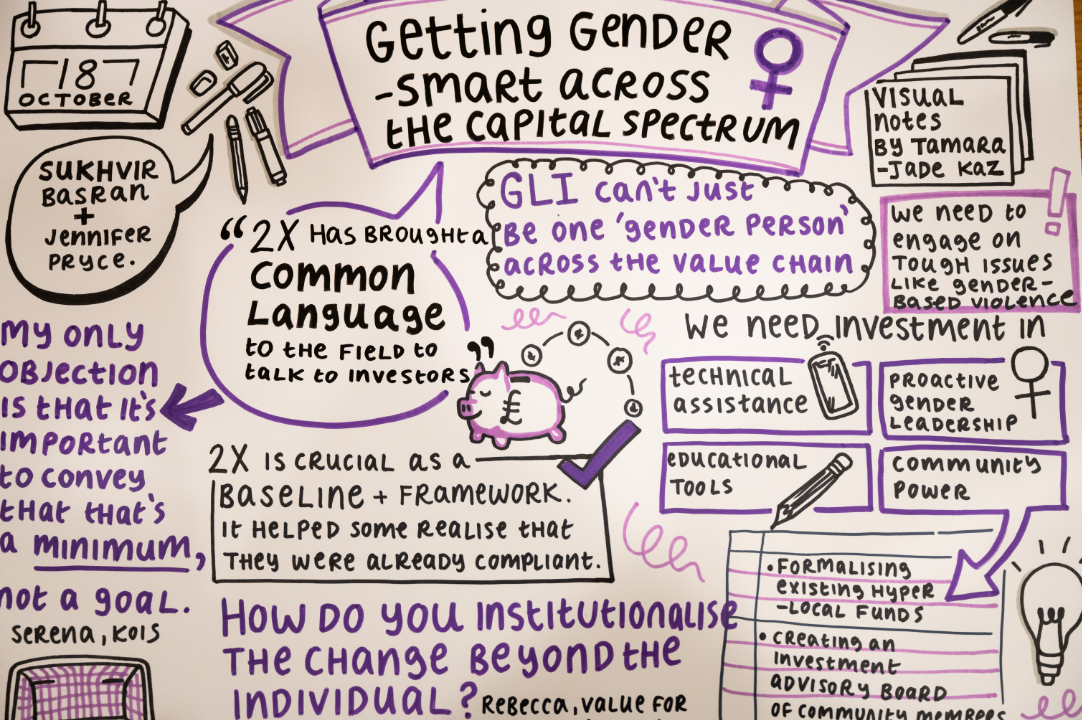

Sukhvir Basran established and leads the Hogan Lovells Global Sustainable Finance and Investment Group. Combining her substantial experience as a banking and finance lawyer, including in cross-border acquisition finance, Sukhvir advises and works with a range of corporates, banks, funds, direct lenders and sponsors on incorporating innovative financing and impact investment structures anchored in rigorous impact outcomes into mainstream transactions. She also advises clients on ESG strategies, policies, disclosure and reporting, ESG-related transactions and products as well as integration of ESG into investment processes and systems.

Suzanne is founder of Catalyst at Large Ltd and is a globally-recognised expert on gender-smart investing. Her work has influenced hundreds of funds and institutional investors, and billions of dollars of capital to move with a gender lens.

Marla Blow is the President and COO of the Skoll Foundation where she leads Skoll’s program work, grants, investments, and financial management, including operations, endowment, and portfolio partnerships. Previously, she was North America lead at the Mastercard Center for Inclusive Growth, and before Mastercard, she was Founder and CEO of FS Card Inc., a subprime credit card venture (sold to strategic acquirer).

Carey Bohjanen operates at the interface between finance, business and society to build more inclusive, equitable and sustainable economies. She drives transformational change, leveraging collective wisdom and untapped potential of people and capital. Carey connects leaders to purpose and passion to develop catalytic, forward-looking responses to our planet’s greatest challenges, particularly gender inequality and climate change.

Jen Braswell is Managing Director and Head of Impact for the Private Capital business at EQT, focusing on defining and rolling out best practice approaches to impact management, impact selection and impact measurement. Jen is also the founding Director of the 2X Collaborative and has had a long career in sustainability, economic development and impact investing having spent 7 years at British International Investment (formerly CDC Group plc), where she was a founder of the internal Impact Management Group and led advisory teams driving value creation through an Impact lens focusing on climate change, gender & diversity finance, job quality and skills.

Sandrine Dixson-Decleve is an international and European climate, energy, sustainable development, sustainable finance, complex systems thought leader. She is currently the Co-President of the Club of Rome and divides her time between lecturing, facilitating difficult conversations and advisory work. She currently Chairs the European Commission, Expert Group on Economic and Societal Impact of Research & Innovation (ESIR) and sits on the European Commission’s Sustainable Finance Platform.

Jessica Espinoza is CEO of the 2X Collaborative, a global industry for gender lens investing convening the entire spectrum of capital providers. She is also Chair of the 2X Challenge that has raised more than US$ 11 billion of gender lens investments since its launch at the G7 Summit in 2018. Jessica has a track record in originating, structuring and executing debt, mezzanine and equity deals in emerging and frontier markets with a strong focus on inclusive innovation. The latest innovation she is spearheading with 2X colleagues is 2X Ignite, a bold facility to unlock capital for gender-smart business at scale by backing female-led fund managers.

Dr. Kshama Fernandes is the Vice Chairperson of the Northern Arc Group and Executive Chairperson of Northern Arc Investment Managers. Northern Arc is a leading finance platform in India that connects underbanked institutions and businesses to capital markets investors. Kshama served as the Managing Director and CEO of Northern Arc Capital from 2012 to 2022.

Elias Habbar-Baylac is a Venture Fellow at Third Space, a Fellow at the Berkeley Center for Equity, Gender & Leadership, and an Entrepreneurial Finance Fellow at the Berkeley Haas School of Business. Elias is a gender finance and inclusive innovation professional, experienced as a strategist & investor in sustainable development & economic inclusion across direct deals & as LP, with a focus on opportunity, gender & diversity-lens investing, ESG, climate & sustainability, & financial services.

Sarah is the Responsible Investment Associate for Gender Equality at HESTA. HESTA is an Australian pension fund for workers in the health and community services sector, and more than 80% of its 950,000 members are women. Sarah leads HESTA’s gender equality investment initiatives and supports HESTA to further deepen its approach to gender lens investing. Sarah is passionate about understanding power dynamics and the intersections between social justice issues and strives to bring intersectional analysis to her work.

Shalaka Joshi is the Gender Lead, South Asia for the International Finance Corporation (IFC)- the private sector focused arm of the World Bank- where she works on gender in the private sector. Shalaka has over 18 years of global leadership experience in early-stage investing, social venture, financial inclusion, entrepreneurship, livelihoods and market-based solutions to poverty in emerging markets, especially in Asia.

Sana is Head of Content at GenderSmart, where she curates and develops programming for the global gender finance community. She leads the Justice, Equity, Diversity and Inclusion Working Group and a Care Economy initiative. A gender smart investing specialist and global changemaker, her career has spanned development finance, impact investing and equity research.

Harvey is a Senior Advisor at FSG and an independent consultant, with over two decades of experience across venture philanthropy, strategy consulting and international development. Harvey has worked extensively with donors, investors and companies to develop and scale inclusive business models that benefit poor and marginalised populations.

Sophie is the Founder and CEO of Kite Insights, as well as the Editorial Partner of the Women’s Forum for the Economy & Society and Curator of the New York Times Climate Hub. Sophie has two decades of professional services and consulting experience and is a globally recognised thought leader on gender and climate action.

Andrew Lee is Global Head of Sustainable and Impact Investing for UBS Global Wealth Management's Chief Investment Office. In this capacity, he and his team provide investment strategy, advice and thought leadership on integrating sustainability and impact into investment portfolios across asset classes.

Simba Marekera is the Head of Investment Management at Brightlight Group, an impact investing fund manager dedicated to investing with the goal of transforming lives. He specialises in innovative financing and blended finance across a variety of Private Markets asset classes including infrastructure, real estate and credit/private debt both in developed and developing markets.

Kanini Mutooni is a Managing Director at Draper Richards Kaplan, a Venture Philanthropy institution focused on investing in global early stage entrepreneurs creating impact. She is also a Senior Adviser for Toniic, the global action network for impact investors with over 300 asset owners representing over $16b in investible wealth.

Hedda is the CEO of TIIME, an impact catalyst - driving capital towards positive societal impact (#impactimperative). She is a private investor, independent director, adjunct professor and advisor on issues related to sustainable development, impact finance and JEDI.

Raya Papp is Founding Partner at SAGANA, a global impact investing and advisory firm where she focuses on Healthcare and Gender-Smart Investments. Raya also advises PE/VC funds in integrating a gender lens across their firm, investment processes and portfolio companies. She co-authored several reports in the sector including "Gender Lens Investing in Waste Management and Recycling" and “Gender Lens Investing Landscape - Asia”.

Jennifer Pryce is President and CEO of Calvert Impact Capital. For 25 years, Calvert has strived to make markets work for more people, more often, by investing in communities overlooked by traditional finance. Calvert invests globally, spanning sectors such as affordable housing, environmental sustainability, microfinance, renewable energy, and small business.

Kelly Roberts-Robbins serves as Senior Consulting Director at Sagana. Throughout her career, Kelly has focused on gender lens investing, gender smart banking, and impact measurement and management. Kelly is passionate about strategy development through impact assessments, and efficient interventions that improve impact and business performance.

Bahiyah Yasmeen Robinson is a recognized innovator of new avenues for VC and Impact investment. Her expertise in leading technology, investment, and social impact initiatives since the early 2000s culminated in creating VC Include in 2018 to build platforms and programs for diverse emerging managers globally.

Darian is an accomplished impact investor, social entrepreneur, conference producer, and best-selling author. His work “helping people help” started during his five-year tenure as Executive Director of Craigslist Foundation, after which he co-founded several social impact conference series, consulted to a wide range of mission-led clients, and supported the UN's development of the SDGs around gender and climate.

Vicki Saunders is an entrepreneur, award-winning mentor, advisor to the next generation of change makers and leading advocate for entrepreneurship as a way of creating positive transformation in the world. Vicki is Founder of Coralus (formerly SheEO) and #radical generosity a global initiative to radically transform how we support finance and celebrate female entrepreneurs.

Laurie Spengler is an impact investment banker, Board member and a recognised contributor to the impact investing industry. Laurie has over 25 years’ experience in international development with a focus on strategy, capital raising, mergers and acquisitions and private equity transactions.

Head of Content Sana Kapadia gives us a whirlwind tour of the key themes and findings from the 2022 Summit, structured within a framework of strategic leverage points.

At the 2022 GenderSmart Investing Summit Marla Blow, COO of the Skoll Foundation - where she oversees the investment of their endowment among other things - talks about why bold leadership is critical to transforming systems of finance. Thanks to film partner Be Inspired Films.

A provocative and persuasive plea to rethink our systems of finance in service of a sustainable society and planet.

A candid conversation between two leaders in gender-smart investing at the 2022 Summit.

Our only plenary discussion at the 2022 Summit asked representatives from across the capital spectrum what actions they're taking to unlock more strategic and impactful gender-smart capital.

We closed out the 2022 Summit with the London International Gospel Choir performing a beautiful rendition of Andra Day's Rise.

A performance of Stone by Shagufta Iqbal, written for the 2022 Summit and inspired by this year's theme of Traction to Transformation. Download the text of the poem here

Co-Founder of GenderSmart Suzanne Biegel reflects on all she has heard over the two day gathering, thanks the team, and reiterates the vision for the work ahead.

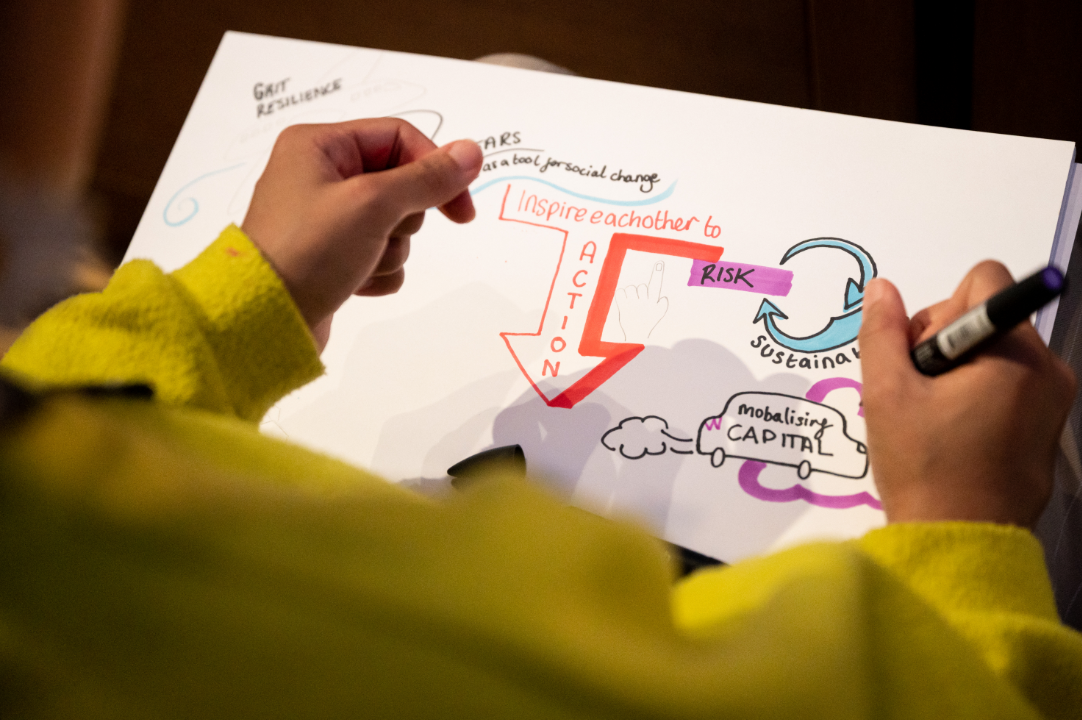

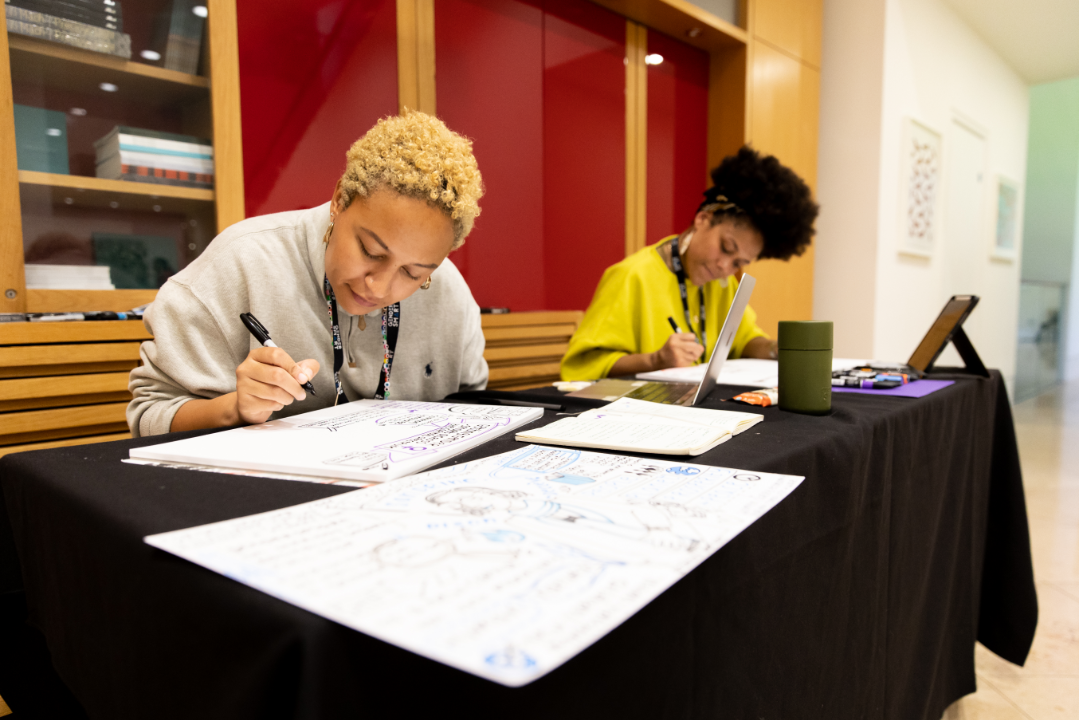

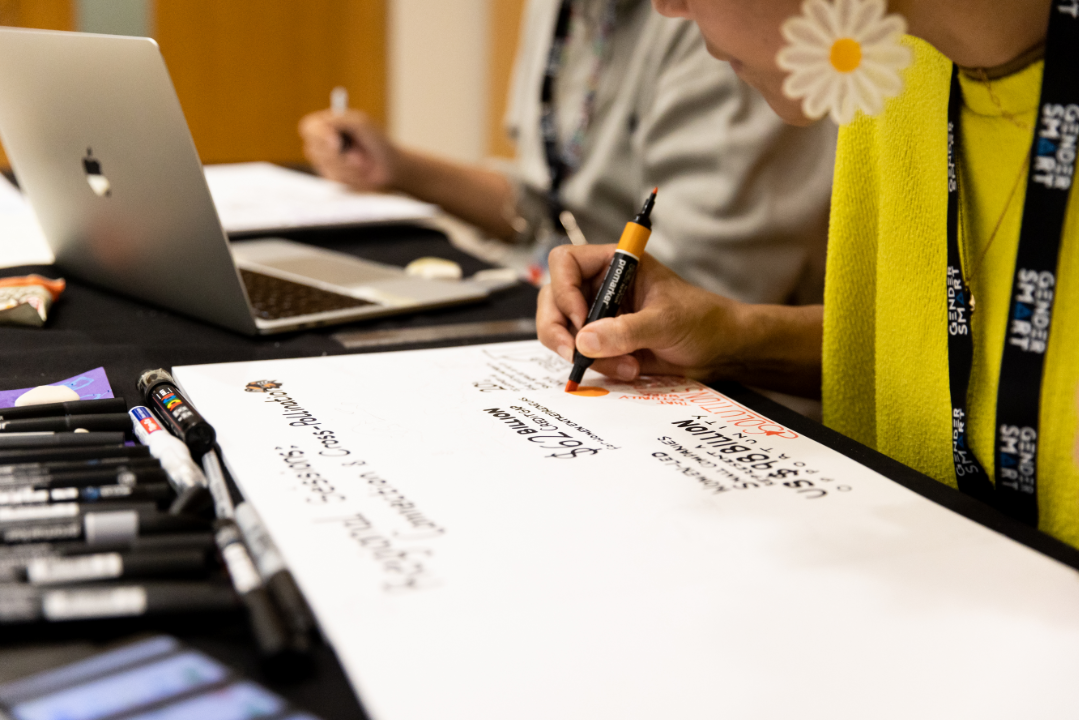

Photos

Thank you to Mickey and team at The Coco Studio